If you have already called your financial to see exactly what the criteria is actually getting a company mortgage, you have currently located the level of papers may possibly not be for your needs to suit your disease. Because of most of the red tape banking institutions have experienced particular of the members interested in choice choices towards the loans. Shorter records has grown to become a a normal practice inside the low-traditional business loans, nearly to the stage where it looks these firms might possibly be also easy.

Hit since the iron’s scorching!

Through to the banking crisis out of 2008, the banks was basically creating money in order to anyone who you’ll fog a great echo. Subprime financing and Alt-An applications managed to make it easy to qualify for a home loan, almost anyone can be a homeowner. Depending on the time, people very benefited from the version of programs, they were able to to get several attributes and possibly flipped them for grand payouts otherwise kept them due to their profile. Nevertheless the trick right here are the timing, they grabbed advantageous asset of the software that have been to nowadays that those apps commonly offered more its more challenging to locate characteristics while making money. Alternative team credit was doing as long as brand new money which might be funded are performing. In the place of the loan crisis in which this type of financing visited default, the banks was required to end investment less than people details.

Protecting a business Financing with minimal if any Records

Of numerous loan providers typically demand consumers doing numerous versions, surrounding bank comments, resource confirmation, tax returns, balance sheets, earnings validation, plus. While a comprehensive paperwork process could possibly offer advantages, additionally show exceedingly go out-drinking. Conventional finance companies, noted for its sluggish pace, tend to get off borrowers waiting around for working-capital for extended attacks.

The good news is one small business owners actually have this new solution to get fund with minimal to help you zero documents criteria. To start with Money Company Loans, i eliminate the dependence on too-much financial record articles so you’re able to lenders. We’ve optimized the money process to have convenience and you will show.

Acknowledging you to definitely small businesses lead hectic lifetime, the reduced-records fund are designed for rate, letting you spend some some time where it things very.

According to who you want to fit into, they all provides more standards. Nevertheless the popular factors necessary when obtaining a working money loan:

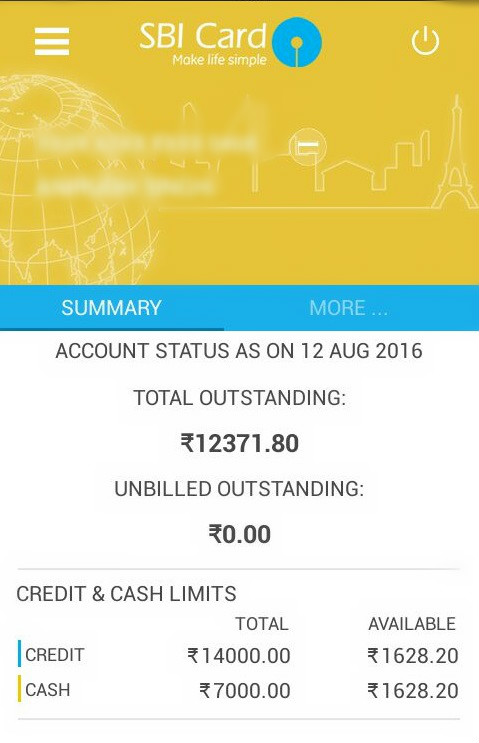

- three to six months bank statements from all of the team bank accounts for the most previous weeks

- 3 to 4 weeks charge card handling statements my review here for the most present months for folks who company procedure playing cards

- Software (this is certainly from around 1 to 2 profiles, but standard guidance)

Barely do you actually come across lenders asking for taxation statements otherwise financials, although not it is not uncommon with the larger financing amounts. Things listed above shall be adequate to enable you to get an address if they give you a corporate mortgage. Turnaround moments locate an answer is frequently inside 24 period, in the event the bank/broker you are coping with is providing more than 2 days you might want to reconsider who you happen to be using the services of. If you commit to brand new terminology you will get loan data within an identical big date, at that point the financial institution will be requesting more activities.

- Nullified consider throughout the company family savings so that they can wire the cash

- Copy regarding People License or Passport to prove you are the business owner(s)

- Sometimes they need to would a webpage evaluation of your own business and then make they think more more comfortable with the latest financing.

- Duplicate off voided leasing find out if your company is leasing it’s place, for those who have a mortgage they’ll like to see your own most recent financial report exhibiting that you will be current.

- Spoken confirmation towards the business owner and also the funding source, they will certainly talk about the borrowed funds terms towards the entrepreneur once more to make certain it grasp all of them.

Develop that may make you best about what might be necessary whenever trying to get a non-conventional team loan. There can be another great website who may have a great deal of factual statements about loans, below are a few united states out to find out more regarding the providers investment. Needless to say everyone has yet another circumstances as well as your condition will be a tiny some other, if you’d like to learn more feel free to chat having our team creativity managers. They can be achieved during the 888-565-6692 .