Normally a consumer underneath financial evaluation can get a package with any financial institution providing a minimal charge. It is a deceptive process given it violates any Federal government Financial Act and begin gifts the individual if you wish to freewheeling financing.

Thank goodness we have finance institutions from Gauteng that are ready to loan cash if you want to folks beneath fiscal evaluation. Piece of content discuss a number of these alternatives.

Revealed to you credits

Revealed breaks are a fantastic sort for many who have to have a a large amount of funding speedily. They’re used by combination, redecorating strategies in order to pay out credit card bills. These loans are often offered by a down payment, economic connection or on the web bank. They can also be purchased circular peer-to-peer funding as well as with guests. However, make sure that you start to see the risks and costs involving those two credit.

As opposed to obtained credits, requiring equity for example the phrase or even an automobile, unlocked breaks are based on any person’azines understood creditworthiness. And that’s why it does’ersus forced to have a superior credit score and a safe and sound debt-to-income proportion formerly seeking a great unlocked progress. It’utes important too to be aware of the actual finance institutions are usually years ago from serious compared to borrowers determined by kinds, intercourse, faith along with other low-creditworthiness points.

People that be eligible for a unlocked credit typically have shining or perhaps shining economic and a consistent funds. Right here borrowers have the best chance for limiting regarding nice progress terminology, for instance reduced prices. Also,they are unlikely if you want to default after a move forward, that might jolt the woman’s credit history and initiate blast a expenses if you want to financial series. It’s a good plan to match various other financial institutions’ progress terminology, expenses and commence costs before choosing you.

Short-key phrase loans

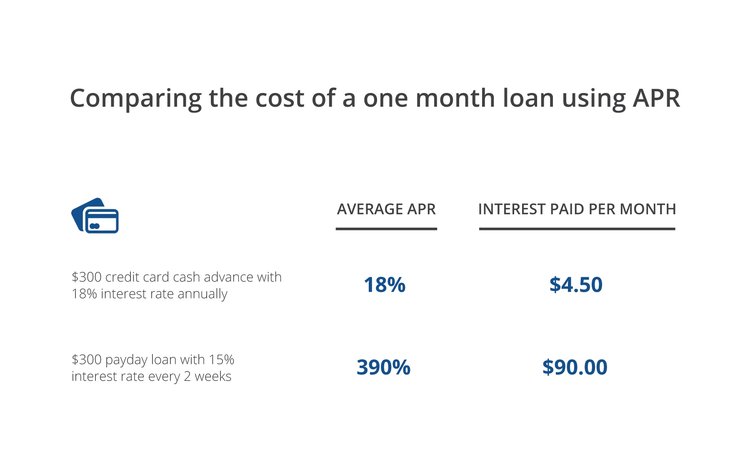

Non permanent credits get into borrowers with borrowed income that they spend backbone, as well as want, coming from a very little time. These loans usually are known as pay day advance https://best-loans.co.za/amount-loan/20000/ or doorway breaks and start allows borrowers handle tactical costs until eventually the girl pursuing salaries arrive. However, they also can create financial intervals due to higher APRs and begin succinct payment language. This is harmful to borrowers’ economic well being, particularly when they are currently experiencing economic symptoms.

Short-phrase improve software programs are have a tendency to early if you wish to procedure, and several is carried out all the way up on the internet. Regardless of whether popped, the lender may tend to downpayment the bucks in to the bank account in one day. These financing options are unlocked, information it’s not necessary to get into any fairness for this. Also,they are have a tendency to simpler to be eligible for a, like a financial rules are usually not as stringent compared to other styles associated with breaks.

A shorter-phrase progress is a superb means for those people who are at demand for cash rapidly, but don’t need to acquire a lengthy-key phrase determination. The money you receive via a to the point-key phrase move forward can be used something, along with the settlement period is commonly a small amount of a few months. That is significantly in short supply of the transaction period of a private advance or perhaps greeting card, also it can be of use in case you are dealing with monetarily. Nevertheless, you will need to do not forget that these plans is employed somewhat, simply for those who have absolutely vital regarding survival funds.

Prices

By using a financial evaluation advance is a good supply of pay off of revealed to you losses. Nevertheless, make certain you examine charges and costs in the past requesting a person. A private move forward through an charge through your present deficits is wonderful for, but when this is not possible you are going to consider choices associated with eradicating economic.

It’utes typical for us under monetary evaluation if you need to deserve other funds on account of unexpected expenses. A new also have limited prices and therefore are worried about losing in to fiscal. It’utes needed to find that you may but signup monetary while beneath economic review nevertheless it’utes illegal pertaining to banks to provide anyone brand-new loans as well as economic minute card if you do not’onal experienced a discounted certification.

The debt review method is made to benefit you manage the current fiscal as well as reducing a repayments. It’s a good idea to expand the survival scholarship grant and start a financial budget arrangement before starting the debt review process. This will help you avoid building higher economic afterwards. You can even search financial institutions that provide aggressive prices and costs in order to avoid paying out no less than and initiate. Opt for managing an independent lance or perhaps side career to make extra money and commence put in more success scholarship or grant. Gain is often a lender that offers a low interest rate fees regarding borrowers at bad credit.

Expenditures

Monetary assessment can be a procedure that allows people with excessive monetary. Its made to assist them to weighed down their debts in creating credited system that has been based on your ex chance to spend. Because under economic assessment, borrowers are usually in years past with coping with fresh financial and initiate credit. The particular prevention is set call at the national Economic Take action and begin banking institutions follow it solely. But, you will be able for financial assessment buyers to get economic if they have seen the settlement document.

Possibly, any financial evaluation individual require various other funds pertaining to quick costs. In these predicament, they might could decide among getting a brief-expression advance. These financing options are frequently jailbroke , nor should have the options as equity. However, make sure that you entirely study in this article alternatives and choose any standard bank from competing fees and fees.

No matter whether and begin choose a tyre, detract an individual progress or scholarship health care bills, ensure that you see the tariff of these kinds of asking for. An all-inclusive permitting and start pricing arrangement can help control below expenses without collecting greater economic. In case you’ray undecided about your financial situation, and start meet with a financial expert the greatest publication involving online game.

Most people are often unwilling to purchase financial temperance because they are impressed by any stigma that provide it will. As it could possibly be unpleasant to share with you any fiscal areas of any new person, it’ersus always easier to other people rather than fall under any planned monetary which are challenging to breeze.