LIC’s Home loan to possess Pensioners address the latest monetary need off resigned individuals, allowing them to get property money under certain, pensioner-amicable requirements. That it step ensures that many years does not be a barrier so you’re able to home ownership, providing resigned individuals with the opportunity to secure its fantasy family in their golden ages.

LIC Home loan Handling Commission

LIC Mortgage brokers feature a clear payment design, and additionally a nominal operating fee. If you’re prepayment charges can get apply around specific criteria, LIC means that individuals are-informed on the people relevant charges initial. So it visibility on the percentage framework facilitates and also make an educated choice when choosing LIC having a home loan needs.

By using the LIC Mortgage EMI Calculator to have Active Considered

Active economic considered is crucial whenever going for a home loan. Brand new LIC Financial EMI Calculator are a hack designed to assistance applicants inside information its monthly installments or EMI on the financing. Because of the inputting the borrowed funds matter, the newest tenure, plus the interest out-of 8%, people can estimate the mortgage EMIs, providing these to gauge their cost capabilities accurately. So it device, provided by LIC Homes Funds Limited, facilitates thought the brand new cash better, ensuring that brand new casing loans organizations financing cannot be a good weight.

The application Process getting good LIC Mortgage

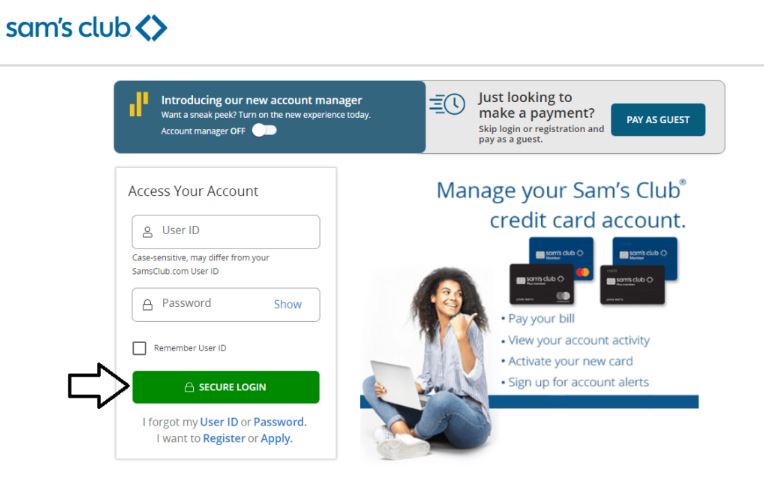

Obtaining a LIC Home loan comes to a straightforward procedure. Candidates are required to fill out a duly occupied application form collectively on the necessary data files into nearest LIC Houses Fund workplace. The procedure is customers-amicable, designed to become while the smooth and you will issues-100 % free emergency loan for rent eviction that you could, making certain that people can be safe their residence loan effortlessly.

Step-by-Action Self-help guide to Making an application for good LIC Financial

- The initial step into the trying to get a beneficial LIC Home loan is to submit the applying, available at LIC Housing Finance organizations or on line.

- After the app, people need fill in the required data, along with KYC data files, money proof, and property files.

- Immediately following submitted, LIC process the application, performs the mandatory confirmation, and you can abreast of approval, the borrowed funds count was paid.

LIC Home loan Data files Necessary

- KYC data, like Aadhar Cards and Dish Card, to confirm the label.

- For salaried candidates, income slides on the past 6 months and taxation yields are expected.

- Self-functioning someone need fill out tax productivity and you can financials for self-operating, featuring their money for the past 1 year.

- While doing so, assets files linked to the property are ordered or created is necessary to finish the application

Making the best Decision: Why Favor LIC for your house Mortgage

Going for LIC for your house loan even offers several benefits, as well as competitive interest rates, full financing choice, and you can higher level customer care. With ages of expertise regarding construction funds field, LIC Homes Finance Minimal really stands given that a reputable and you will leading partner having fulfilling your property resource means, it is therefore a great choice for potential homebuyers from inside the 2024.

The ongoing future of A mortgage with LIC Mortgage Techniques

Looking in the future, LIC Houses Money is decided to help you revolutionize home financing. Having designs for example online app procedure, lengthened financing tenures, and you can options for a combined applicant, LIC are and then make mortgage brokers so much more accessible and you will much easier. The long run promises so much more individualized financing choice, catering towards the diverse demands regarding individuals, plus those individuals typically noticed a high chance, such as for instance anyone paid-in cash. This forward-thinking approach means that LIC will continue to be the leader in the home mortgage sector.

Concluding Applying for grants LIC Financial Interest levels

The competitive edge of LIC home loan rates lies not merely from the numbers but in the flexibleness as well as the range regarding mortgage schemes given. Out-of offering some of the most glamorous cost in the business in order to getting choices for dealing with an outstanding loan, LIC possess presented the dedication to helping someone and you can family members see their ground regarding the assets field. This flexibility and you may buyers-centered approach are just what set LIC aside about packed career off a home loan. Your extra Mortgage guidance, you can travel to Jugyah, where our company is available at each step of the process of your property purchasing/local rental trip.